Randall’s Value Added Savings Programs

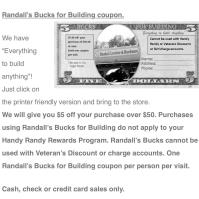

Randall’s Bucks for Building coupon.

We have “Everything to build anything”! Just click on the printer friendly version and bring to the store.

We will give you $5 off your purchase over $50. Purchases using Randall’s Bucks for Building do not apply to your Handy Randy Rewards Program. Randall’s Bucks cannot be used with Veteran’s Discount or charge accounts. One Randall’s Bucks for Building coupon per person per visit.

Cash, check or credit card sales only.

To honor our Service Men & Women both veteran and active duty, Randall Lumber & Hardware offers a Veteran’s Discount on every cash sale. Just ask our sales staff for the “Veteran’s Discount Program” and show your ID card at the time of your purchase. Thank you all for your service and your sacrifice!

Cash flow isn’t just a line item buried in a spreadsheet—it’s the bloodstream of any business trying to stay alive beyond its first year. While some founders chase investor attention or flashy expansion, the ones who stick around are usually those who keep a close eye on their cash game. Revenue might be loud and impressive, but cash flow is what actually pays the bills, covers payroll, and allows for that next smart investment. It’s not about obsessively pinching pennies—it’s about understanding where every dollar is going and where it should go next.

Build a Realistic Buffer, Not a Fantasy

A lot of owners talk about saving for a rainy day, but too many of them confuse optimism with strategy. Without a cash cushion, even a single late payment from a major client can trigger a chain reaction—missed payroll, halted vendor services, or worse. A working reserve equal to at least three months of operating costs gives breathing room and bargaining power. It’s not about hoarding cash, it’s about staying calm when things don’t go according to plan—because they often won’t.

Structure Pays Off

Creating a limited liability company can lead to smoother, more predictable cash flow by keeping business finances clearly separate from personal ones. For those exploring how to form an LLC in New Mexico, the structure also brings tax flexibility and credibility, both of which can improve vendor relationships and payment terms. With a formal business entity, it’s easier to manage inflows and outflows, apply for financing, and project expenses with less guesswork. You can also avoid hefty attorney fees by registering the LLC yourself or using a reputable business formation service.

Invoice Like It Matters—Because It Does

Too many small businesses treat invoicing as an afterthought, sending bills out late and hoping clients remember to pay on time. That habit quietly drains resources and builds bad financial habits. Set a rhythm for invoicing that’s as structured as your morning coffee: same days, same terms, same follow-ups. And if the budget allows, use software that automates reminders and flags problem accounts early before they become expensive lessons.

Don’t Let Inventory Sink the Ship

Inventory might seem like an asset, but if it's sitting too long on the shelf, it turns into a liability—tying up cash that could be working somewhere else. Small businesses often overestimate demand, thinking more stock means more sales, but excess inventory just eats into liquidity. Smarter tracking systems and tighter purchasing decisions help maintain better control without slowing down fulfillment. The goal is fluid movement—not stockpiles that collect dust and quietly bleed the bank account.

Watch Spending, Not Just Earning

Growth-focused founders sometimes think they can earn their way out of bad spending habits. But that mindset turns cash flow into a guessing game that the business usually loses. Each expense, no matter how small, should be vetted not just for necessity but for timing—just because the money’s there doesn’t mean it should be spent right now. Smart cash flow management means knowing when to hold back and when to push forward, not just saying yes because revenue had a good month.

Negotiate Everything—Then Negotiate Again

Vendors, landlords, freelancers, service providers—they’re all willing to play ball if there’s trust and clarity. Small business owners too often take terms at face value, missing opportunities to stretch payment deadlines or trim unnecessary fees. Negotiating doesn’t require being ruthless; it just requires knowing your numbers and asking the right questions. Those few extra weeks or discounted terms can make all the difference when cash flow is tight but commitments don’t pause.

Plan for Tomorrow, Not Just Today

Short-term fixes might stop the bleeding, but long-term planning keeps the heart beating. Forecasting cash flow based on real numbers—not hopes—is a discipline every small business needs to develop early. That means understanding cyclical income patterns, planning for taxes before they’re due, and keeping multiple scenarios ready so pivots don’t become panics. It’s not about predicting the future perfectly—it’s about preparing to move quickly when it doesn’t go according to plan.

There’s no trophy for making it through the year without a financial meltdown—but that’s exactly the win most small business owners should aim for. Healthy cash flow is what turns a side hustle into a sustainable enterprise and gives founders the control they need to make real strategic choices. It's not the flashiest part of the job, but it’s the most crucial—and often the difference between staying open or closing up. The businesses that get this right don’t just survive—they grow, adapt, and stick around long enough to do something that matters.

Discover the vibrant culture and rich history of Taos County by visiting the Taos County Chamber of Commerce and start planning your next adventure today!

There’s a quiet killer lurking behind many failed small businesses, and it’s not a lack of good ideas or market demand—it’s the cash flow crunch. The most creative products, efficient services, or beloved neighborhood spots can vanish if they run out of working capital. Maintaining a healthy cash flow isn’t just about keeping the lights on; it’s about building a business that can flex, adapt, and grow. While profitability might be the long-term goal, it’s cash flow that keeps the day-to-day alive, and too many owners learn that lesson the hard way.

Get Real About Incoming and Outgoing Money

A lot of entrepreneurs like to operate on gut instinct, but when it comes to cash flow, precision beats intuition. You can’t make informed decisions if you don’t know what’s coming in and going out, so tracking every dollar is non-negotiable. This means breaking habits like “ballpark” forecasting and investing time in solid bookkeeping practices—ideally with someone who knows their way around more than just QuickBooks. Regular cash flow statements should become familiar reading material, not just something glanced at before tax season.

Structure Brings Breathing Room

Choosing to register as a limited liability company can offer more than legal protection—it can also help stabilize your business’s cash flow. With an LLC, you often gain tax advantages and more favorable treatment when it comes to securing financing or negotiating vendor agreements. The structure itself signals professionalism, which can lead to more consistent payments and better terms. While some entrepreneurs assume they need a lawyer, you can save on attorney fees by registering an LLC through self-filing or a reputable business formation service—especially if you already know how to form an LLC in New Mexico.

Avoid the Panic Spend

When a business gets its first real taste of growth, there’s often a temptation to spend fast and wide—new equipment, branding upgrades, expanded staff. But healthy growth doesn’t mean reckless spending, and not every dollar needs to be deployed right away. Smart owners pause to examine what expenses are genuinely scalable versus those that feel urgent but aren’t essential. Sustainable expansion is rooted in careful financial pacing, not in sudden splurges that leave the bank account gasping.

Stagger Payments to Suppliers When Possible

One often overlooked way to gain more breathing room is by negotiating payment terms with suppliers. Asking for net-30 or net-60 terms, instead of paying invoices immediately, can free up cash for other pressing needs without damaging relationships. Of course, this requires some tact and trust, but many vendors are open to conversations if the track record is solid. Better yet, maintaining clear communication about expected payment dates can keep those relationships smooth and mutually beneficial.

Prioritize Cash Reserves, Not Just Revenue

It’s easy to fall into the trap of focusing only on increasing sales, but revenue isn’t the same as liquidity. Customers might pay late, seasonal swings may catch you off guard, and emergencies don’t wait for your profit margin to stabilize. Building and protecting a cash reserve gives your business resilience—the ability to handle a bad month without spiraling. It’s not glamorous, but setting aside a portion of revenue regularly can be what saves you when things turn sideways.

Make It Easy (and Fast) for Customers to Pay

Cash flow stalls when payments get stuck in limbo. If invoicing is slow, systems are outdated, or payment options are limited, customers have no incentive to pay promptly. Streamlining the accounts receivable process—using digital invoicing platforms, offering multiple payment methods, and setting up automatic reminders—can speed things along. Clear terms, upfront expectations, and a gentle nudge can mean the difference between getting paid in days versus weeks.

Leverage Short-Term Financing Wisely

Sometimes a little strategic borrowing can act as a bridge between lean months and stronger ones. But not all loans are created equal, and piling on debt without a clear payoff plan can backfire. Lines of credit, short-term loans, or even business credit cards might help smooth temporary gaps, but they should never be used to cover up recurring cash shortages. Used with discipline, financing can help a small business stay nimble; used recklessly, it becomes an anchor.

Cash flow isn’t just a financial metric—it’s the bloodstream of every small business. Chasing growth without monitoring liquidity is like driving a car without watching the fuel gauge. By focusing on smart, steady strategies that prioritize flexibility and foresight, business owners give themselves room to maneuver when challenges appear. At the end of the day, survival and success are often separated by something as unassuming as how money moves in and out of the business.

Discover the vibrant culture and rich history of Taos County by visiting the Taos County Chamber of Commerce and start planning your next adventure today!

Proven Strategies to Maintain Financial Stability and Growth

Running a small business means balancing ambition with cash flow discipline. The heartbeat of your business isn’t revenue — it’s liquidity. When you maintain healthy cash flow, you gain the freedom to seize opportunities, weather downturns, and invest in future growth.

This guide breaks down practical, high-leverage methods for maintaining strong financial stability — complete with actionable checklists, FAQs, and tool references you can apply today.

Understanding Cash Flow Dynamics

Before mastering cash flow, business owners must understand its key components:

-

Operating Cash Flow: Income generated from your business operations.

-

Investing Cash Flow: Cash used for or received from asset purchases and sales.

-

Financing Cash Flow: Funds from loans, investors, or owner contributions.

Tip: Use free tools like Wave Accounting to visualize your inflows and outflows weekly.

Healthy cash flow means your operational income consistently exceeds expenses — not just seasonally, but throughout the year.

Structuring Your Business for Predictable Cash Flow

The foundation of financial stability is structure. Without a clear business entity and legal framework, your finances blur — making forecasting and tax planning difficult.

One effective step for small business owners operating in the Southwest is understanding how to form an LLC in New Mexico. Establishing an LLC helps separate personal and business finances, shield assets, and streamline tax deductions.

Once you have this structure in place, implement:

-

A dedicated business account for all transactions.

-

A 12-month rolling budget that forecasts every quarter.

-

A monthly “cash position” review comparing actual vs. expected performance.

These simple practices create transparency and ensure that every dollar is accounted for — a cornerstone of sustainable growth.

Core Cash Flow Management Strategies

Here’s a summary table of the most effective cash flow tactics and what they accomplish:

|

Strategy |

Purpose |

Time Frame |

Tools |

|

Invoice Promptly |

Maintain liquidity by shortening payment cycles |

Weekly |

Zoho Books |

|

Negotiate Vendor Terms |

Improve outflow timing |

Quarterly |

Fundbox for invoice financing |

|

Maintain an Emergency Reserve |

Cushion against seasonal dips |

Ongoing |

High-yield business savings account |

|

Forecast Cash Flow |

Anticipate shortages early |

Monthly |

Excel, Float, or Fathom |

|

Automate Collections |

Reduce late payments |

Weekly |

Stripe, Square, or Chargebee |

The Healthy Cash Flow Checklist

Use this checklist to ensure your financial system is designed for durability:

Separate personal and business bank accounts

Review cash flow reports at least twice per month

Maintain three months of operating expenses in reserve

Set payment reminders for overdue clients

Automate recurring bills and collections

Reinvest 10–20% of net profits into growth channels

Review loan interest rates annually for refinancing opportunities

For deeper automation and bookkeeping integrations, explore platforms like Bench Accounting that simplify reconciliation and reporting.

Growth-Oriented Financial Habits

Sustaining cash flow is about more than just cutting costs — it’s about optimizing your cycles.

Reinvest Wisely

Use positive cash flow to invest in:

-

Employee training that raises efficiency

-

Marketing campaigns with proven ROI

-

Upgraded software that reduces recurring manual tasks

Monitor KPIs

Track metrics such as:

-

Days Sales Outstanding (DSO) – average time to receive payment

-

Net Profit Margin – profitability per dollar of revenue

-

Operating Cash Flow Ratio – liquidity efficiency

Review these in dashboards like LivePlan to stay data-informed.

Scenario Planning

Create best-, base-, and worst-case financial projections. This habit reveals when to borrow, hire, or delay expansion — protecting your runway.

FAQ: Cash Flow Questions Every Small Business Owner Asks

Q1: How can I improve cash flow if clients often pay late?

Offer small early-payment discounts (2–3%) or introduce automated reminders through accounting software.

Q2: Should I take a short-term loan to stabilize cash flow?

Yes, but only after assessing your forecast. Use financing tools like American Express Business Blueprint to fill temporary gaps — not to fund recurring expenses.

Q3: How much cash reserve should my business maintain?

Ideally, at least three months of operational expenses, though six months is safer for seasonal industries.

Q4: How do I balance reinvestment with savings?

Follow the 70-20-10 rule — spend 70% on operations, save 20%, and reinvest 10% into growth initiatives.

Common Mistakes to Avoid

-

Overestimating future income: Always base projections on conservative estimates.

-

Ignoring taxes: Allocate 25–30% of income for quarterly tax payments.

-

Poor credit management: Pay off high-interest debts first to reduce long-term drag.

-

Underpricing products: Review margins quarterly to maintain profit stability.

Pro Tip: Tools like Expensify help identify where leaks occur and can flag unnecessary recurring charges.

Building Financial Agility

Cash flow stability is not static — it’s adaptive. Businesses that thrive in unpredictable markets share three traits:

-

Forecast before funding: They don’t rely on emotion to make spending decisions.

-

Automate for insight: They use integrated dashboards to track liquidity in real time.

-

Protect their legal structure: They operate through compliant entities that shield personal finances and support scalability.

Cash Flow is Your Business Lifeline

Healthy cash flow isn’t just about survival — it’s about growth with control. By combining structure, automation, and foresight, small businesses can stay resilient through every cycle.

Regularly assess your liquidity, plan ahead, and use reliable tools to reinforce discipline. Whether you’re starting with a fresh LLC, scaling an existing business, or managing debt cycles, consistency and clarity will ensure your financial engine keeps running smoothly.

Coupon 1

15% off one regular

priced Item

worth between

$100 and $199

Coupon 2

20% off one regular

priced item worth between

$200 and $299

Coupon 3

25% off one regular priced

item worth $300

or more

Valid only at the Taos location.

In store only.

Can not be combined,

with any other offer.

MUST PRINT OFF THE PHOTO OF THE COUPON

AND BRING THE COUPON INTO

THE TAOS LOCATION STORE IN PERSON ONLY!

Taos Mountain Outfitters

113 N. Plaza

Taos, NM 87571

575-758-9292 (office)

TCCC Highlight: Did you know? Some local museums offer free admission to local residents.

TCCC Highlight: Did you know? January 2025

Did you know that some of our local museums offer free admission to local residents?

It’s time to explore some of the amazing opportunities to learn about the history and culture of Taos and the people. Museums offer visitors a learning experience that help people connect with people from different cultures and religions. They also offer immersive learning experiences that help shape perspectives. Most importantly, museums help to preserve the past.

So, what are you waiting for? Visit one or more of our local museums with friends and family.

| MUSEUM | PHONE | WEBSITE | HOURS OF OPERATION |

| COUSE-SHARP HISTORIC SITE | (575) 862-0369 | https://couse-sharp.org/ | 2-hour tours by appointment Mon–Sat |

| 146 Kit Carson Road | Gallery hours Tue–Sat 1–5 for exhibitions when installed | ||

| MILLICENT ROGERS MUSEUM | (575) 758-2462 | https://www.millicentrogers.org/ | Open 10 AM-5 PM six days a week (Closed Wednesdays Nov - March) |

| 1504 Millicent Rogers Road | Taos County Residents FREE SUNDAYS | ||

| Tribal Members FREE | |||

| Docent Tours (48 hr. notice required) $5.00 + Admission | |||

| TAOS ART MUSEUM AT FECHIN HOUSE | (575) 758-2690 | https://www.taosartmuseum.org/ | April - October: Tues to Sunday 11 AM - 5 PM |

| 227 Paseo del Pueblo Norte | November - March: Tues to Sunday 12 PM - 4 PM | ||

| Taos County Residents FREE SUNDAYS | |||

| HARWOOD MUSEUM OF ART | (575) 758-9826 | https://harwoodmuseum.org/ | Wednesday – Sunday: 11 AM - 5 PM |

| 238 Ledoux Street | CLOSED: Monday & Tuesday | ||

| KIT CARSON HOUSE, INC. | (575) 758-4945 | https://www.kitcarsonhouse.org/ | Tuesday - Saturday 11 AM - 4 PM |

| 113 Kit Carson Rd | Sunday 12 PM - 4 PM | ||

| Taos County Residents / Free | |||

| TAOS HISTORIC MUSEUM | |||

| Blumenschein Home and Museum | (575) 758-0505 | https://www.taoshistoricmuseums.org/ | Winter Hours: Mon, Tues, Fri & Sat 10 AM - 4 PM |

| 222 Ledoux Street | Sunday Noon to 4pm (weather permitting) | ||

| Hacienda de Los Martinez | (575) 758-0505 | https://www.taoshistoricmuseums.org/ | Winter Hours: Mon, Tues, Fri & Sat 10 AM - 4 PM |

| 708 Hacienda Way | Sunday Noon to 4pm (weather permitting) | ||

| D.H. LAWRENCE | (575) 776-2245 | https://taos.org/places/d-h-lawrence-ranch/ | Tuesday - Thursday: 9:30 AM - 3:30 PM |

| 506 D.H. Lawrence Ranch Rd. | Call for more information | ||

| San Cristobal, NM |

Call for more information. Hours and days of operation may change.

The item is at regular priced.

One coupon per person.

One coupon per month.

MUST PRINT A COPY OF THE COUPON.

Bring the printed coupon copy into the store.

.jpg)

Whether you are looking for a remote workplace with great internet access, visiting Taos for an extended ski vacation, or just looking for a quiet get away you will enjoy the serenity of our special property..

BIRTHDAY BLISS

Free entry to the Springs on your birthday for all New Mexico Residents.

Valid anytime including holiday periods with New Mexico ID. Birthday Bliss free entry is only valid on actual birth date.

http://www.ojospa.com

HOT DEAL:

50% off venue fees for Taos County Businesses and Nonprofits!

CONTACT: Christian Whetsell | Hotel Don Fernando de Taos – Hampton Taos | Area Director of Sales & Marketing| Office: 575-758-4190

Christian Whetsell <cwhetsell@shanercorp.com>

Host your Holiday Party with Hotel Don Fernando de Taos!

ALL Taos County Chamber of Commerce Members Receive 50% off Venue Fees!

Contact Christian Whetsell, Director of Sales, at cwhetsell@shanercorp.com

.jpg)

.jpg)

.jpg)

Enjoy 50% Off Your Sunday Stayover With Three Night Stay. Based On Friday Arrival With Consecutive Stay.

.jpg)

Enjoy 50% Off Your Sunday Stayover With Three Night Stay. Based On Friday Arrival With Consecutive Stay.

.jpg)

.jpg)

Have FUN!

The Harwood Museum of Art brings Taos arts to the world and world arts to Taos

The Harwood Museum showcases a diverse tapestry of over 100 years of art in Taos. We enhance learning, creativity, and cultural life for the Taos community by enabling the power of arts to honor the past and inspire the future.

.jpg)

Shop local this holiday season with custom apparel, merchandise, and collectibles created at 6,969 ft. Use code TCCC and save 10% site wide at 6969taos.com. Valid through 12/31/25.

.jpg)